Micro-Fulfillment 2.0 - How the Micro-Fulfillment System Design is Changing

Micro-fulfillment can be described as the concept of combining warehouse automation and retail stores in urban areas to locally fulfill B2C eCommerce orders. The combination of automated order fulfillment technology, co-located in urban areas, brings inventory closer to the end-user, while leveraging the productivity and efficiency of automation.

This de-centralized fulfillment strategy enables retailers to instantly fulfill customer orders while reducing cost per picked unit and final-mile delivery costs. Essentially, it is currently the best strategy out there for retailers to keep up with the emerging on-demand economy. In just a few years the market has produced a number of micro-fulfillment solution providers:

In theory, micro-fulfillment systems offer a low upfront investment, fast deployment, and maximum order fulfillment efficiency. However, in reality this is not always the case. Micro-fulfillment solutions are evolving as retailers and solution providers are learning from the early generations and designs of micro-fulfillment solutions and strive towards adapting and improving the design to overcome some of the initial shortfalls:

Challenges:

- Limited inventory:

- Micro-fulfillment technology is basically a down-sized version of existing warehouse automation technology. The most common micro-fulfillment system design, a three-aisle Shuttle system that fits into 10,000 SF, doesn’t offer sufficient storage capacity to hold the assortment and inventory needed

- Cost:

- The entry level cost for micro-fulfillment solutions is rather high, starting at approx. $5,000,000 USD, service & maintenance not included

- Size:

- This technology is advertised to fit into 10,000 SF. But that’s only half the total space required for all related processes

- Productivity:

- Typically, 70% of the volume is picked by the automated system, and 30% picked on the store floor. This is highly unproductive and drags down the overall productivity rate

- Building Infrastructure:

- The building infrastructure requirements are often underestimated (floor slab, power, noise levels, building clear height, etc.)

- Operating Cost:

- The annual operating cost, combined with service and maintenance cost, can be excessive

- Transaction Fees:

- Sales based transaction fee models. Some MFC providers charge x% of each sales transaction coming out of their system to the retailer that owns and operates the system

- Host Integration:

- The system host integration can be complex and requires many resources and experience

- System installation:

- A typical micro-fulfillment system requires 10-12 months from contract execution to Go-Live

- Once built, it also cannot be redeployed

- Slotting:

- How to slot the micro-fulfillment machine in order to maximize its efficiency? What days-on-hand inventory delivers the right balance? How do I efficiently replenish the system? These questions are often left unanswered by the solution providers

There is a consensus that a de-centralized fulfillment strategy, on which micro-fulfillment is based, is also the best strategy to capitalize on today’s growing E-Commerce market. However, the real challenge is finding the right automated system technology and designing the right size. Furthermore, IT systems integration, system installation time and life-cycle costs are other major factors that also need to be considered.

So what is the solution? Do the most common micro-fulfillment solution providers have an answer to the challenges listed above? Or are they trying to stick a square peg in a round hole?

In fact, since micro-fulfillment solutions were first introduced to the market in 2018, a lot has evolved since then. The problem with micro-fulfillment is the “micro” part of it. It is limited in size and therefore limited in its storage capacity. Retailers who have been experimenting with micro-fulfillment concepts have shifted their focus and priorities. Retailers eyeballing micro-fulfillment are now restructuring their priorities based on:

- Assortment & inventory

- How can I maximize SKUs and days-on-hand inventory?

- How can I manage and maintain my inventory efficiently?

- Volume

- What % of orders and order lines can I fulfill through my automated system?

- Fulfilling orders on the floor is cost prohibitive and highly inefficient

- Speed

- How fast can I fulfill an order?

- Is a faster order fulfillment promise reducing the size of the average customer order basket?

- Order consolidation:

- How efficient or cumbersome is my order consolidation process?

- Location:

- Stores are physically not optimal by design

- Is there sufficient parking space?

- Are the noise prohibitions?

- Modern stores today are very different by design (built into condos and larger downtown building complexes)

Learning from the data now available, the ideal micro-fulfillment system design appears to be changing:

| Previously | Now |

|---|---|

| 5,000 - 10,000 SKUs | 20,000 SKUs |

| 10,000 SF and up to 18’ building height | 40,000 SF and up to 30’ building height |

| 1,000 orders/day | 2,500+ orders/day |

| Fit the technology into the available building | Design the technology first, then find a suitable building |

| Combine floor picking with automation | Automate as much volume as possible |

| Focus on fast order fulfillment | Focus on maintaining larger order basket |

| Importance of hyper-local fulfillment, expanding your reach | Importance of focussing on concentrated areas with higher penetration of online grocery shoppers |

| Underestimated consolidation process | Focus on consolidation process and design sufficient space |

So now that we are a few years into the micro-fulfillment journey, what should retailers and solution providers alike be focussing on? If the strategy is proven, surely the focus must be on the technology.

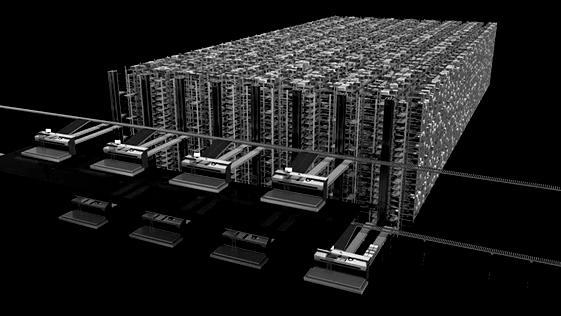

And that is indeed what we are seeing. Micro-fulfillment systems are growing in size, starting at 30,000 SF minimum. The initial concept of putting technology into the back-of-store has proven difficult and unsustainable, as many stores simply don’t have the height required nor the space to build a system that is large enough to meet the operational requirements. Most grocery stores are simply not optimal by design. On top of that, modern stores are changing. They are designed to fit into urban areas, condominiums, and downtown city centers.

New MFC designs are built to hold more inventory, more DOH, and a higher % of volume picked via automation. The selected location also seems to be moving back to the warehouse. It appears the best design for a micro-fulfillment system is a hybrid between an automated warehouse and the initial concept of micro-fulfillment systems in a store.

Many retailers are also evaluating if the threshold for automation has been crossed yet or whether online grocery shopping has peaked? In this post-covid era retailers are challenged with finding the right balance between hyper-local and instant order fulfillment and the traditional hub and spoke model. Determining the role of technology and what the best automated order fulfillment system design is will continue to evolve over the coming years and might differ by region and country.